CA BOE-571-L 2021-2026 free printable template

Show details

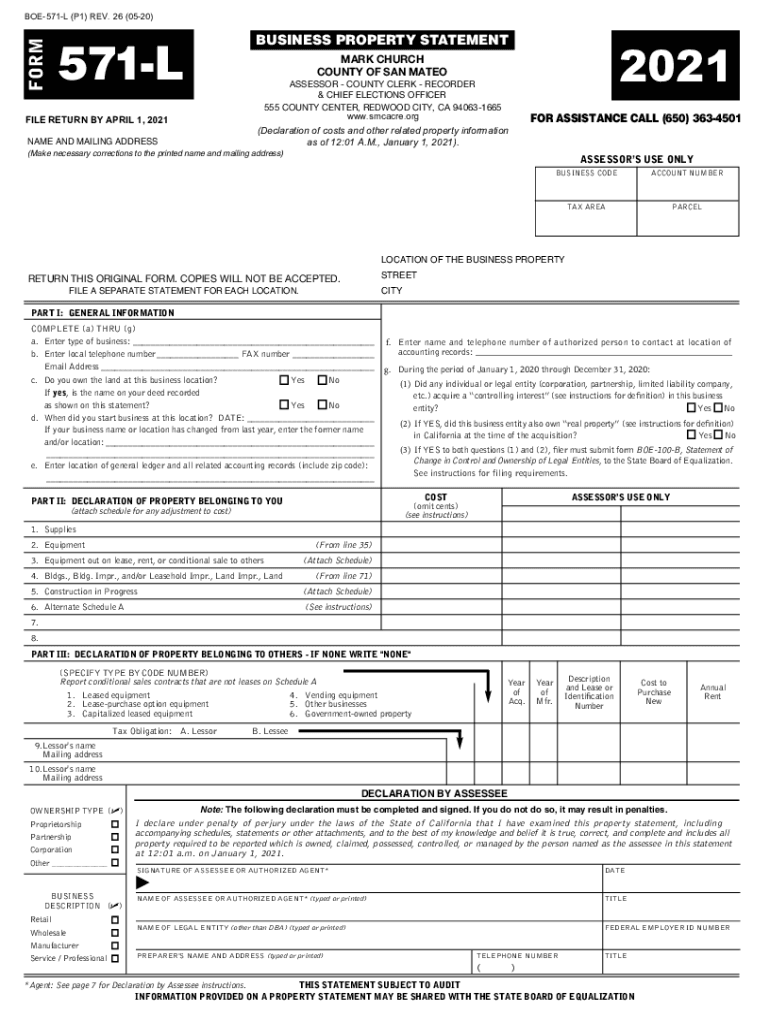

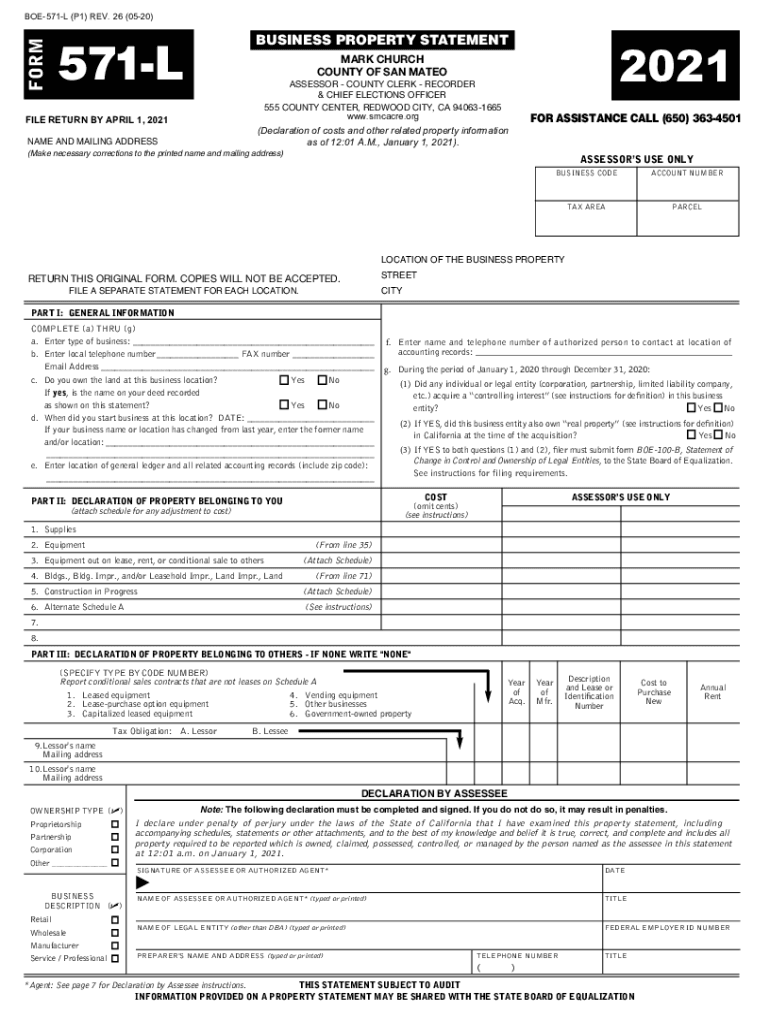

FORM BOE-571-L P1 REV. 22 05-16 BUSINESS PROPERTY STATEMENT 571-L MARK CHURCH COUNTY OF SAN MATEO ASSESSOR - COUNTY CLERK - RECORDER CHIEF ELECTIONS OFFICER 555 COUNTY CENTER REDWOOD CITY CA 94063-1665 www. LINE 6. ALTERNATE OR IN-LIEU SCHEDULE. If the Assessor enclosed BOE 571-L Alternate Schedule A with this property statement complete the alternate schedule as directed and report the total cost on Line 6. The attachments must be in a format acceptable to the Assessor and the property...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 571 form

Edit your business property statement form 571 l form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 583568907 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 571l form online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit boe template form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-571-L Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 571 l

How to fill out CA BOE-571-L

01

Obtain Form CA BOE-571-L from the California Board of Equalization website or local office.

02

Fill in your name and contact information at the top of the form.

03

Provide the address of the property for which you are applying for the exemption.

04

Indicate the type of exemption you are applying for by checking the appropriate box.

05

Complete the sections regarding income and other necessary financial information.

06

Sign and date the form at the designated area.

07

Submit the form to the appropriate local assessor's office by the specified deadline.

Who needs CA BOE-571-L?

01

Property owners in California who are applying for a property tax exemption.

02

Individuals who qualify for specific exemptions based on ownership or income criteria.

03

Organizations seeking tax exemptions for properties used for charitable or non-profit purposes.

Fill

571 l form

: Try Risk Free

People Also Ask about 571 l

Do I have to file a business property statement in California?

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code. Statements are sent in order to gather the most up to date information on the business property so that an accurate value can be determined.

What is a 571 R form?

The 571-R is a State of California tax form required to be completed by rental businesses, including Short-Term Rental businesses.

What is a Form 571 L?

Business Property Statement Filing - EFile You can mail your Business Personal Property Statement (571-L) form to your assigned Assessor's office.

What needs to be reported on 571L?

Report all those business assets used in your business as of January 1. Business assets include, but are not limited to: Machinery and Equipment, Office Furniture and Equipment, Computers, Tools, Molds, Dies, Jigs, fixtures, and Supplies on Hand. * Cost includes sales tax, freight and installation.

What is Form 571 Orange County?

Business Property Statement (571-L Forms) Businesses are required by law to file an annual Business Property Statement if their aggregate cost of business personal property exceeds $100,000, or if the Assessor requests the information. Separate filings are required for each business location.

What is the business personal property tax rate in California?

California's property tax rate is 1% of assessed value (also applies to real property) plus any bonded indebtedness voted in by the taxpayers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 571l for eSignature?

Once your boe forms is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I edit 571 pdf on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing i 571 form right away.

How do I fill out business property statement on an Android device?

Complete your form i 571 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA BOE-571-L?

CA BOE-571-L is a form used by the California Board of Equalization for reporting and claiming a property tax exemption for disabled veterans.

Who is required to file CA BOE-571-L?

Disabled veterans or their eligible spouses who are claiming the property tax exemption for their primary residence in California are required to file CA BOE-571-L.

How to fill out CA BOE-571-L?

To fill out CA BOE-571-L, provide personal information such as name, address, and social security number, details about service-related disability, and information about the property for which the exemption is claimed.

What is the purpose of CA BOE-571-L?

The purpose of CA BOE-571-L is to allow eligible disabled veterans to claim a property tax exemption to reduce their property tax liability in California.

What information must be reported on CA BOE-571-L?

The CA BOE-571-L requires information including the veteran's personal details, service-connected disability status, the address of the property, and proof of eligibility for the exemption.

Fill out your CA BOE-571-L online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Boe Form is not the form you're looking for?Search for another form here.

Keywords relevant to property statement

Related to 571 l business property statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.